W-2 Filing Available for All Businesses and Individuals

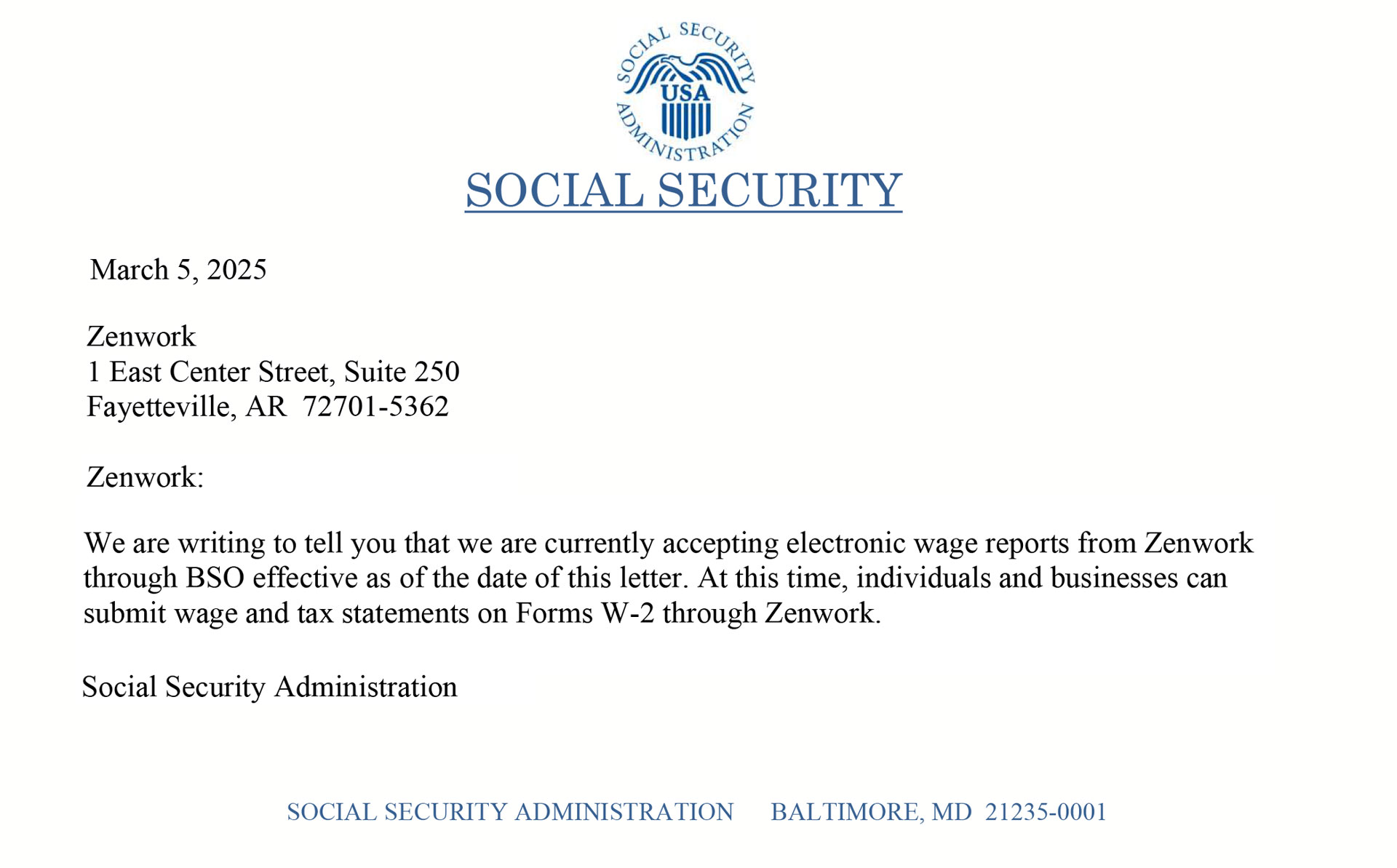

We are pleased to announce that all businesses and individuals can now file W-2 forms with Zenwork. If you previously received a letter from the Social Security Administration (SSA) regarding electronic wage report submissions, please note that the issue has been fully resolved. Our systems are fully operational, and we are processing W-2 and W-2C filings without any disruptions.

Thank you for your continued trust!