While businesses are careful to report the compensation made to employees on payroll, they often fail to report the payments made towards non-employment compensation. This can include disbursements made for contractual work, part-time jobs, interest, rentals, royalties, etc.

However, the Internal Revenue Service (IRS) requires entities to report all types of non-employment compensations of $600 or more. This is done through the 1099 tax forms (a group of tax forms) used to track income that falls outside the realm of traditional W2 wages. In this case, the payer is responsible for filling out the form and sending one copy to the IRS and another to the taxpayer or the income recipient.

So, if you wonder- “Am I required to file a Form 1099 or other information return?” The answer is Yes! If you paid to a small business or self-employed (individual), you are most likely required to file a 1099 to the IRS.

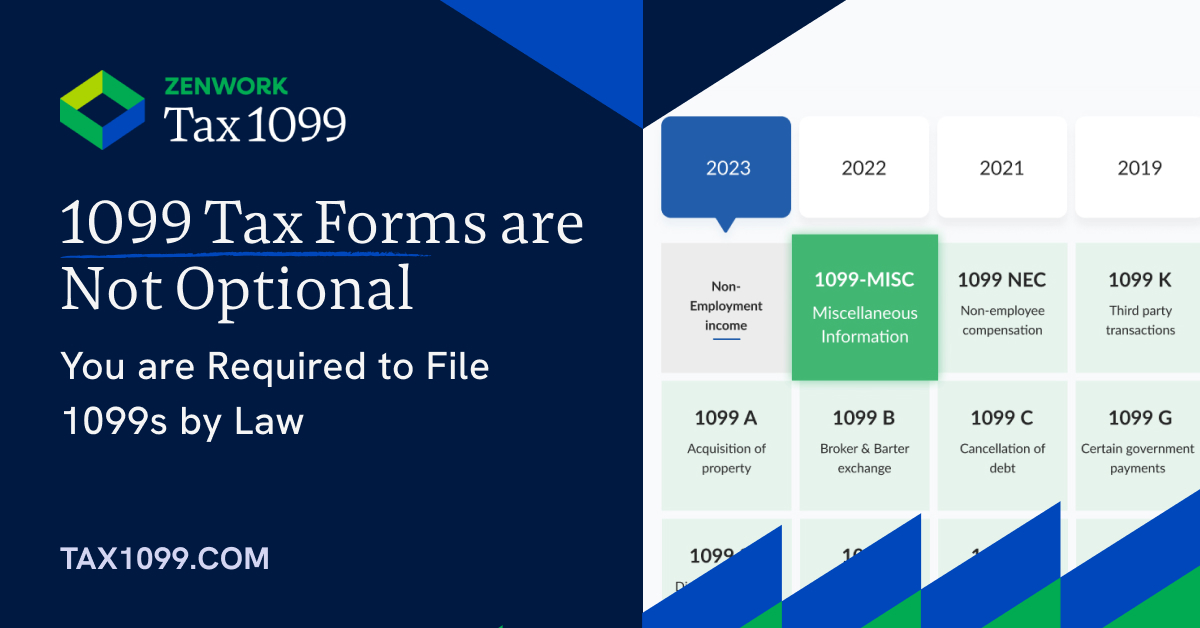

Types of 1099 Forms

There are several types of 1099 tax forms, each designated for specific sources of income. Some common types of 1099 forms are:

- 1099-NEC:

Used to report non-employee compensation (NEC) of $600 or more made to independent contractors or freelancers for services rendered.

- 1099-MISC (Miscellaneous Information):

Used to report payments made to freelancers, independent contractors, or individuals to whom, you have paid:

– At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

– Or at least $600 or more as miscellaneous income. It includes rent, prizes, awards, royalties, Medical and health care payments, crop insurance proceeds, and other miscellaneous income.

- 1099-INT:

Issued by banks or financial institutions to report interest income earned on accounts like savings, checking, or investment accounts.

- 1099-K:

Used by payment settlement entities, like credit card companies or third-party payment networks, to report payment card transactions or third-party network transactions. Generally used for businesses that exceed a certain threshold of transactions.

Note:

The due date for sending the 1099 NEC to the IRS is January 31 of the year.

Importance of 1099 Tax Forms

The 1099 tax forms ensure accurate reporting of all sources of income by acting as a checks-and-balances system. These forms are used so that the paying entity can also report the payments made on their own tax returns.

A majority of all 1099s are matched against the individual and the entity’s tax returns. If there is a discrepancy in matching the 1099 to the recipient’s tax return, the IRS may inform the taxpayer about the additional taxes that are due.

Failure to file the tax information under Form 1099 can invite hefty penalties from the IRS. The IRS charges separate penalties for failing to:

- file a correct information return on time

- provide correct payee statements

The penalty for missed deadlines can range from $60 to $310 per form. Cases of non-compliance resulting due to negligence are subject to a minimum penalty of $630 per form.

| Charges for Each Information Return or Payee Statement | ||||

| Year Due | Up to 30 Days Late | 31 Days Late Through August 1 | After August 1 or Not Filed | Intentional Disregard |

| 2024 | $60 | $120 | $310 | $630 |

| 2023 | $50 | $110 | $290 | $580 |

| 2022 | $50 | $110 | $280 | $570 |

| 2021 | $50 | $110 | $280 | $560 |

| 2020 | $50 | $110 | $270 | $550 |

| 2019 | $50 | $100 | $270 | $540 |

| 2018 | $50 | $100 | $260 | $530 |

| 2017 | $50 | $100 | $260 | $530 |

| 2016 | $50 | $100 | $260 | $520 |

| 2011 – 2015 | $30 | $60 | $100 | $250 |

Note that the IRS charges interest on penalties. The date from when the interest gets added to the penalty depends on the penalty type and amount.

Things to Remember while Filing Information Returns

Here are a few points to remember when filing information returns with the IRS:

- You are not supposed to send a 1099-MISC for personally made payments. Personal payments made to an independent contractor for non-business services don’t fall within the scope of 1099.

- Payments made by credit or debit cards or by online payment services like PayPal or Venmo don’t require you to send a 1099. Such payees will receive a 1099-K from their merchant services provider.

- The information returns must be postmarked or filed by the due date. If you require additional time to file an information return and provide payee statements, you can apply for an extension of time from the IRS.

- If you receive an IRS notice, validate the information on the notice. There may be no penalty if the issue in the notice can be fixed by you. Additionally, you can also dispute a penalty if you don’t agree with the notice.

While all this information may seem overwhelming at first, Tax1099 is here to simplify your journey toward tax compliance. With its intuitive interface and efficient features, the platform empowers users to effortlessly generate, file, and distribute 1099 forms, transforming what can be a complex and time-consuming task into a seamless experience.

Consider Tax1099 as your ally in navigating the intricacies of tax compliance—simplify your tax reporting and stay ahead in the game with Tax1099 by your side.