Your Guide to Pay Federal Taxes Electronically

While most of us eagerly anticipate that sweet tax refund, it’s not guaranteed for everyone. According to data from Civic

While most of us eagerly anticipate that sweet tax refund, it’s not guaranteed for everyone. According to data from Civic

QuickBooks Online provides a range of four distinct versions tailored for businesses. Deciding between QuickBooks Online, QuickBooks for Self-Employed, or other

Beginning on January 1, 2024, many companies in the United States will have to report information about their beneficial owners,

As a business owner or contractor, knowing when you’re supposed to issue a 1099 form is crucial. It’s not just

Form 1099-MISC, Miscellaneous Information, reports payments other than non-employee compensation made by a trade or business to whom they have

When you manage a business with employees, navigating and fulfilling various tax requirements is particularly essential. Two important tax forms

As an employer, understanding the rules and regulations surrounding 1099 forms is crucial to ensure compliance with the IRS and

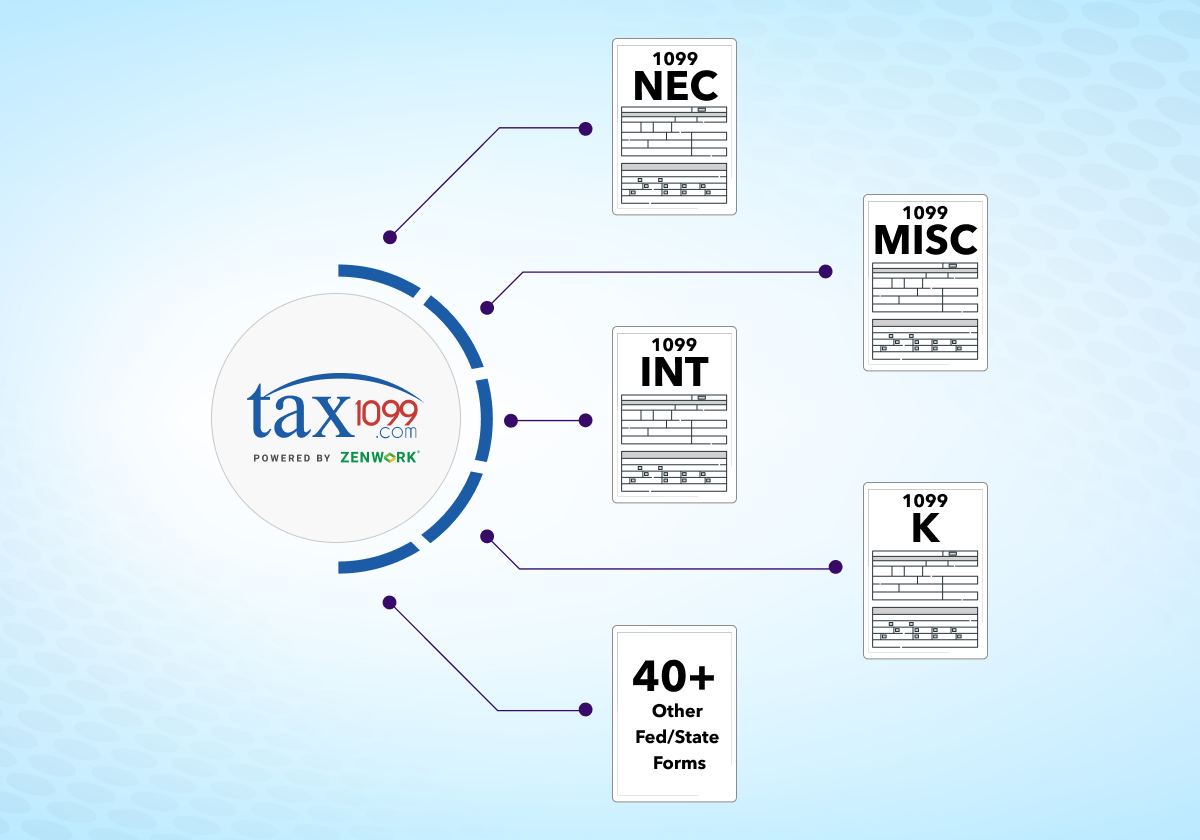

Tax time can be overwhelming, especially for professionals handling complex IRS forms and confusing state filing requirements. That’s where Tax1099

Every technological evolution presents an opportunity to propel scientific exploration, aid individuals, and enhance the overall quality of life. AI

The specific IRS Form 1099 filing due date varies based on the type of form and the chosen filing method.

As we approach the 2024 tax season, there’s a palpable sense of excitement at Tax1099. We’re thrilled about the prospects

Tax compliance is a necessary aspect of running a business, and for companies who issue 1099 forms, accuracy can mean