Compliance in the Gig Economy

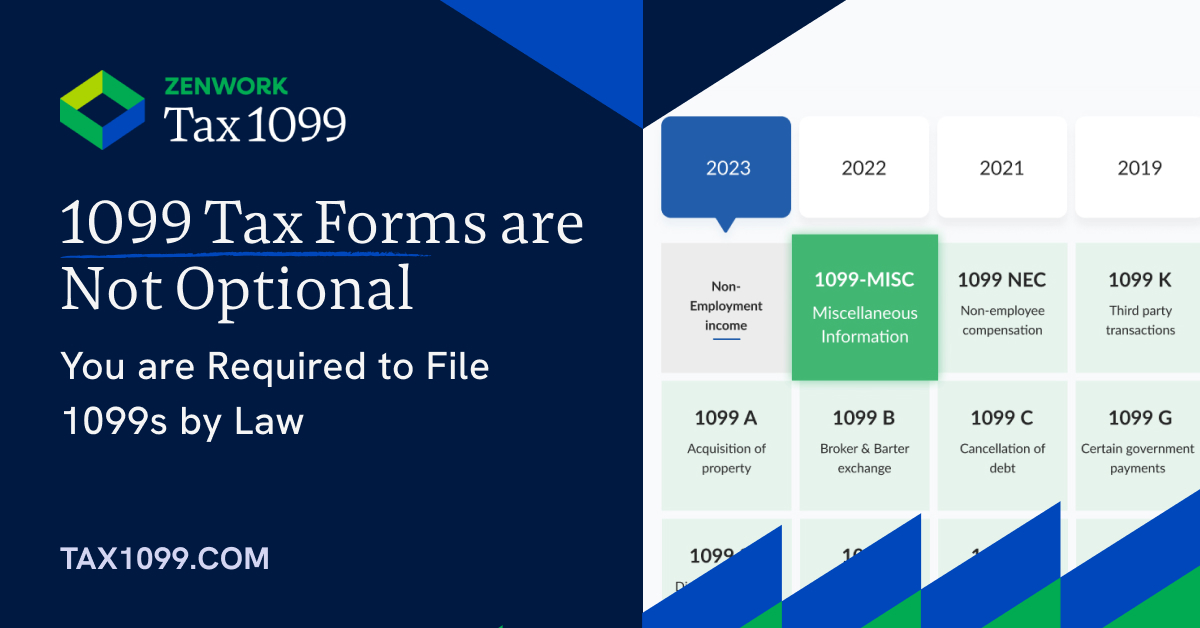

Gig economy employers are required to file the 1099 forms with the IRS.

Home » 1099 Form

Gig economy employers are required to file the 1099 forms with the IRS.

Individuals & businesses are required by the IRS to report all types of nonemployment compensations of $600 or more. This

TIN matching is essential for businesses to verify the accuracy of taxpayer identification numbers provided by vendors and contractors. Reduce

As a business owner or contractor, knowing when you’re supposed to issue a 1099 form is crucial. It’s not just

Form 1099-MISC, Miscellaneous Information, reports payments other than non-employee compensation made by a trade or business to whom they have

As an employer, understanding the rules and regulations surrounding 1099 forms is crucial to ensure compliance with the IRS and

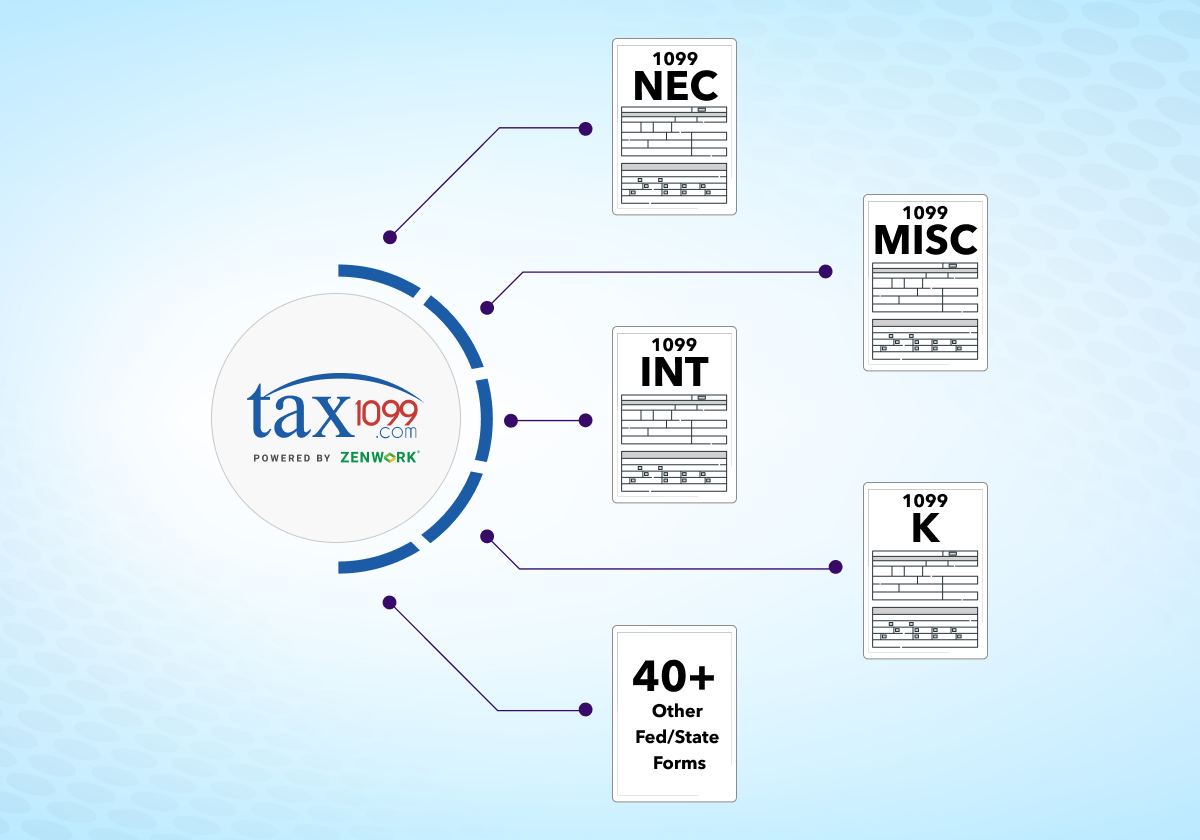

Tax time can be overwhelming, especially for professionals handling complex IRS forms and confusing state filing requirements. That’s where Tax1099

The specific IRS Form 1099 filing due date varies based on the type of form and the chosen filing method.

Tax compliance is a necessary aspect of running a business, and for companies who issue 1099 forms, accuracy can mean

Both Form W-2 and Form 1099 have a common goal: reporting the income earned by individuals throughout the tax year.