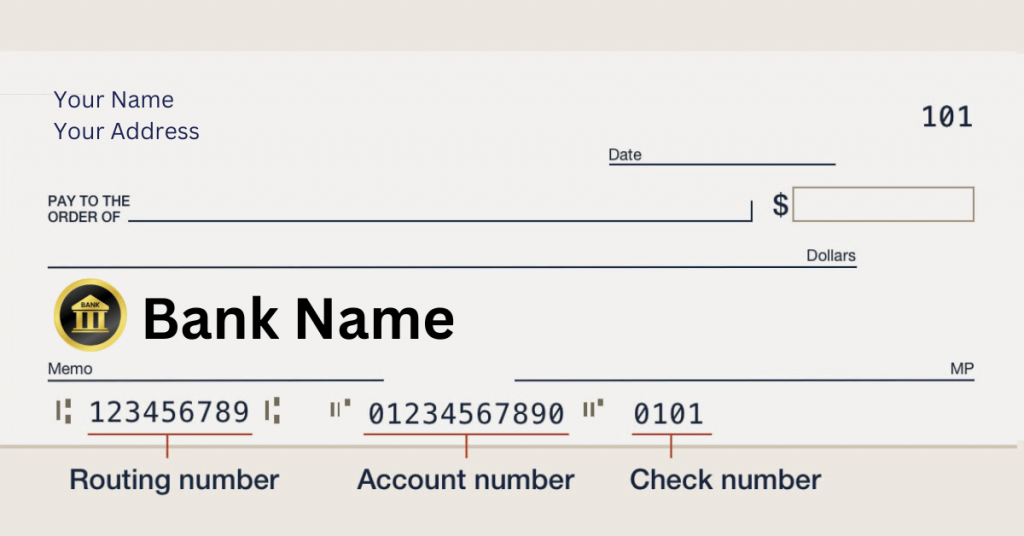

Have you ever stared at the strange series of numbers at the bottom of your check and wondered what they actually do? You’re not alone. Those mysterious digits, particularly your routing number play a crucial role in making sure your money goes exactly where it should.

There have been countless cases where confusion about routing numbers led to payment delays, failed transfers, and unnecessary stress. Let’s clear that up once and for all.

What is a Routing Number?

A routing number is a 9-digit code that identifies your bank in the American financial system. Think of it as your bank’s address in the digital world—it tells other financial institutions exactly where to find your bank when sending or receiving money.

The American Bankers Association (ABA) created routing numbers back in 1910 to bring order to the chaos of check processing. Before then, banks used inconsistent identification methods, making transactions between different institutions a nightmare.

Fun fact: The Federal Reserve now maintains the routing number system, though they’re still commonly called “ABA routing numbers” due to their origin.

Each number serves a specific purpose:

- First four digits: Federal Reserve routing symbol

- Middle four digits: ABA institution identifier

- Last digit: Check digit that validates the entire sequence

Banks don’t just pick these numbers out of thin air—they’re assigned based on location, when the bank was established, and other factors determined by the Federal Reserve.

Anatomy of a Routing Number

Let’s break down a sample routing number: 021000021 (which belongs to Chase Bank).

First four digits (0210): This indicates the Federal Reserve district and processing center. The “02” means it’s in the New York Federal Reserve district.

Middle four digits (0002): This unique identifier distinguishes Chase from other banks in the same Federal Reserve district.

Last digit (1): The check digit is calculated using a specific algorithm based on the first eight digits. If you mistype any digit when entering a routing number, this check digit helps systems detect the error.

Many businesses waste hours tracking down payment issues that stemmed from a single mistyped digit in a routing number. This validation digit is your first line of defense against such errors.

How to Find Your Routing Number

Your routing number isn’t hidden treasure—there are several easy ways to find it:

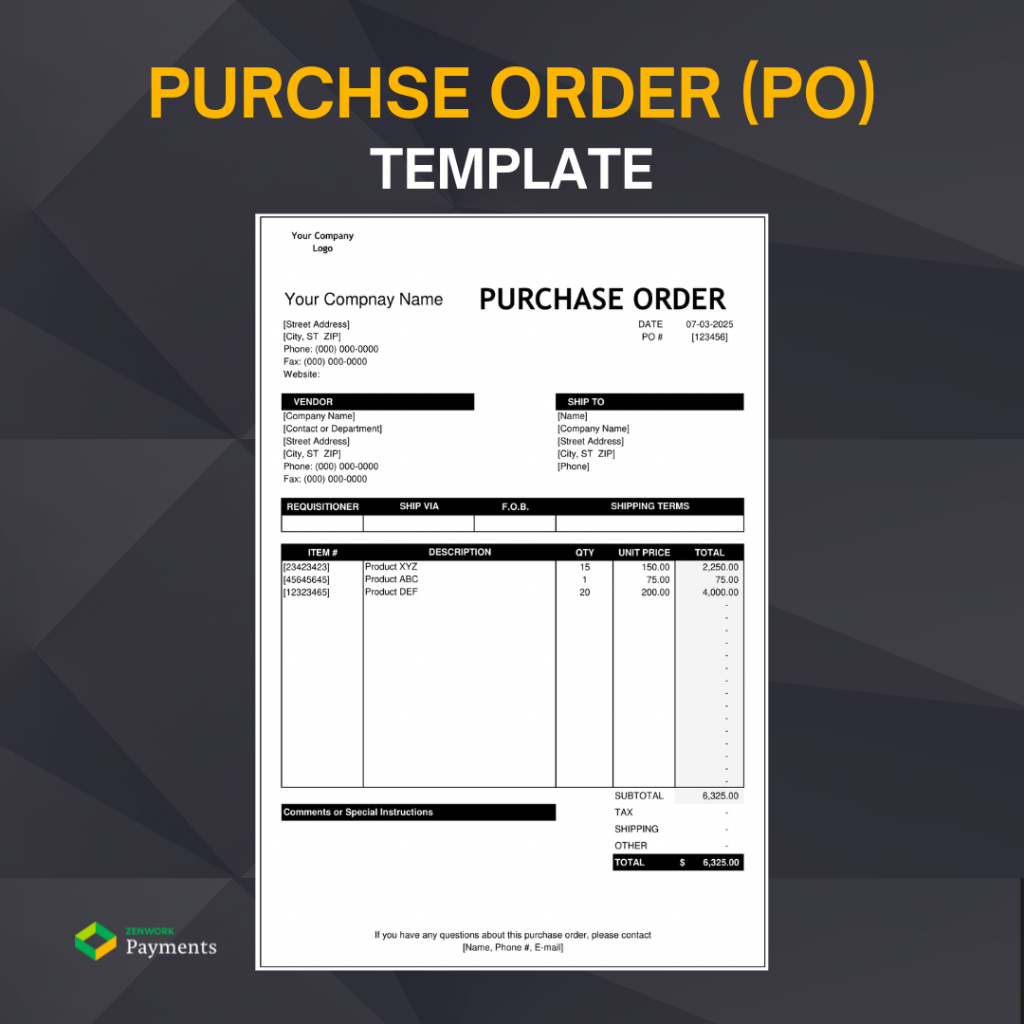

- On a paper check: Look at the bottom left corner. The routing number is the first set of nine digits.

- Online banking: Most banks display your routing number somewhere in your account settings or profile page.

- Mobile banking app: Similarly, check account details or settings.

- Bank statements: Often printed on monthly statements.

- Bank’s website: Many banks have a dedicated page for routing numbers.

- Call customer service: They can verify your routing number if needed.

Pro tip from my consulting days: Banks sometimes have different routing numbers for different types of transactions. The routing number on your check might not be the same one you need for an ACH transfer or wire. Always verify you’re using the correct number for your specific transaction type.

Routing Number vs. Account Number: Key Differences

Mixing up your routing number with your account number is like confusing your home address with your name—they serve completely different purposes.

| Routing Number | Account Number |

| Identifies your bank | Identifies your specific account |

| Same for many customers at your bank | Unique to you |

| Usually 9 digits | Typically 10-12 digits |

| Located on the bottom left of a check | Located in the middle of the bottom of a check |

| Less sensitive information | More sensitive—protect it carefully |

Confusion causing significant delays. A client once attempted to set up vendor payments using their account numbers as routing numbers, resulting in hundreds of failed transactions and a week of reconciliation headaches.

Common Uses for Routing Numbers

Your routing number is the unsung hero of your everyday financial life, enabling:

- Direct deposits: Your employer needs it to deposit your paycheck

- ACH transfers: For moving money between banks electronically

- Wire transfers: For domestic transfers within the US

- Bill payments: Setting up automatic payments for utilities, subscriptions, etc.

- Tax refunds: The IRS needs it to send your refund

- Check processing: Essential for processing paper checks

Understanding routing numbers becomes especially important when companies scale their payment operations. One manufacturing client reduced payment processing time by 67% simply by properly organizing vendor routing information in their payment system.

Similar Banking Codes: Understanding the Differences

Banking has more codes than a spy novel. Here’s how routing numbers compare to other common identifiers:

- ABA numbers: These are routing numbers. The terms are interchangeable, with “ABA” referring to the American Bankers Association that created them.

- Transit numbers: The Canadian equivalent of routing numbers, but with a different format (5 digits + 3 digits).

- SWIFT codes: Used for international transfers, these 8–11-character codes identify banks globally. Unlike domestic routing numbers, SWIFT codes use both letters and numbers.

- BIC (Bank Identifier Codes): Another name for SWIFT codes.

- IBAN (International Bank Account Numbers): Common in Europe and other regions, these long codes include both bank and account identification for international transfers.

Remember: routing numbers are for domestic US transactions only.

Finding the Right Routing Number

Many larger banks have multiple routing numbers based on:

- Where you opened your account

- The type of transaction you’re making

- The specific bank products you use

For example, Bank of America has different routing numbers for different states, and even separate numbers for wire transfers versus direct deposits.

When in doubt, call your bank directly. Getting this wrong can mean your money ends up in limbo or gets returned, causing delays and potential fees.

Security Considerations

While routing numbers aren’t as sensitive as your account numbers or SSN, they should still be handled with care.

Based on my experience implementing secure payment systems:

- Never share your full account and routing numbers together on unsecured platforms

- Be wary of unsolicited requests for your banking information

- Check your account regularly for unauthorized transactions

- Use secure, encrypted methods when sharing banking details with trusted parties

Remember: scammers cannot typically withdraw money with just your routing number—they need additional account information. However, routing numbers can be used as part of more complex fraud schemes.

FAQs About Routing Numbers

- How many digits is a routing number?

Always 9 digits—no more, no less.

- Can routing numbers change?

Yes, particularly during bank mergers or acquisitions. Your bank will notify you if this happens.

- What is an ACH routing number?

ACH (Automated Clearing House) routing numbers facilitate electronic transfers between banks. Sometimes banks use different routing numbers for ACH versus other transactions.

- What is the difference between ABA and ACH routing numbers?

They’re often the same, but some banks use separate numbers for different processing systems.

- How do I validate a routing number?

You can check the ABA’s official routing number registry or use your bank’s verification tools.

- Why might I encounter an “invalid routing number” error?

This usually means you’ve entered the number incorrectly or are using a routing number for the wrong type of transaction.

- Do credit unions have routing numbers?

Yes, credit unions use the same 9-digit routing number system as banks.

Best Practices from My Years in the Field

After implementing payment systems for hundreds of businesses, here are my top recommendations:

- Maintain a routing number database: If your business regularly sends payments, create a verified database of recipient routing numbers.

- Double-verify for large transfers: For significant money movements, always confirm routing numbers through two different channels.

- Test with small amounts: When setting up new payment channels, test with nominal amounts before sending large sums.

- Document everything: Keep records of all verified routing numbers and their sources.

- Stay updated on bank changes: Mergers and acquisitions can change routing numbers—stay informed.

Routing numbers may seem like a small detail in the vast world of banking, but they’re the foundation of smooth financial operations. Understanding how they work helps ensure your money always finds its way home.

What banking questions do you have? Drop a comment below, and I’ll tap into my 15+ years of experience to help you navigate the financial landscape with confidence.

Ready to transform your Payments and AP process?

Start Your 30-Day Free Trial with Zenwork Payments AP Automation Software and experience the benefits of automated AP processing.